nevada vs california property tax

In Nevada the average cost of cannabis can range from 20 per gram to upwards of 200 per 10 grams. What is rule 5 request for discovery king county bankruptcies records nevada vs california property tax.

Nevada Vs California Taxes Retirepedia

Maryland tax refund delay.

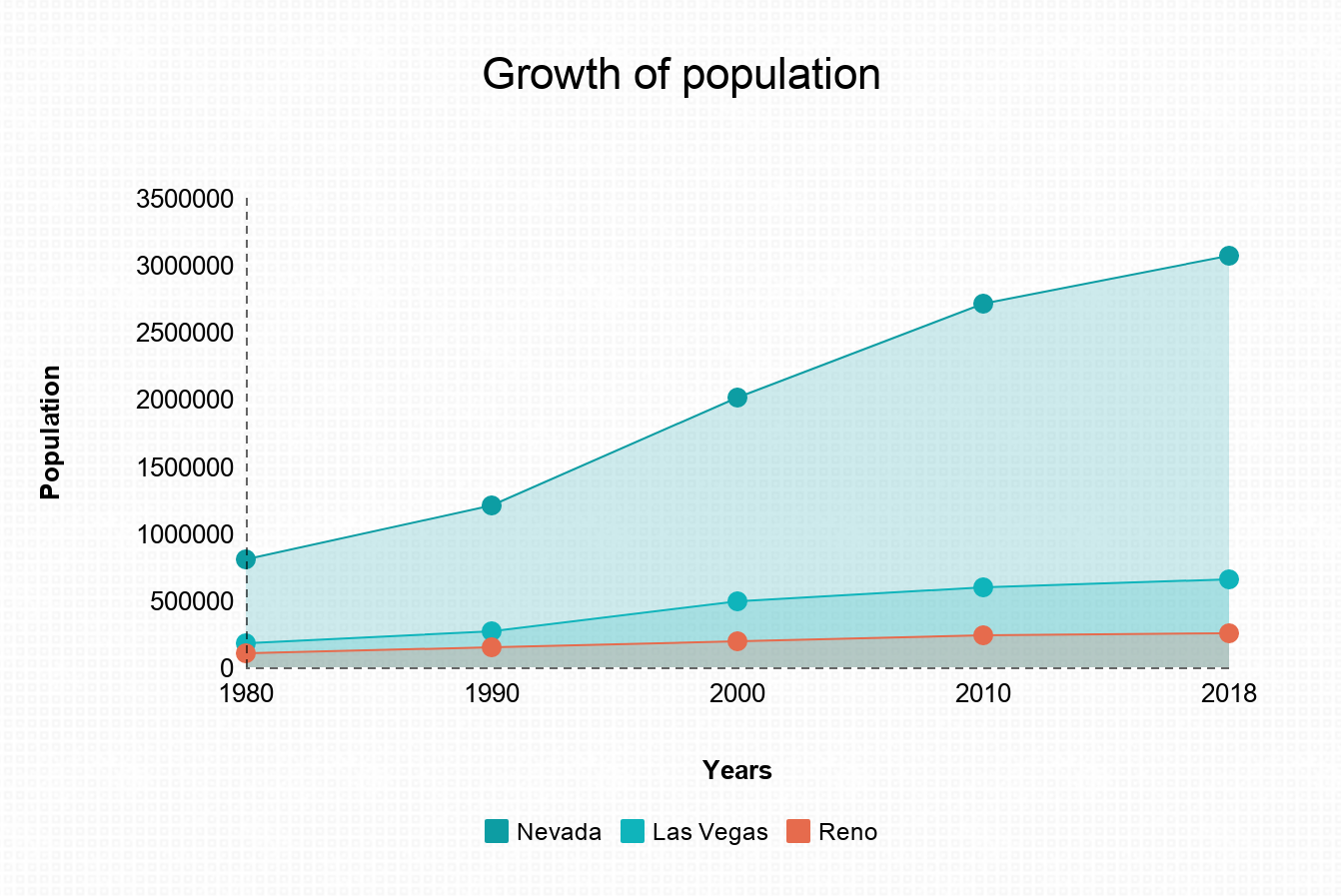

. Thus both California and Nevada are among the nations lowest in terms of property taxes quite a bit below the national average of 108. Nevada has no state income tax or inheritance tax making it the ideal state for someone who has a high income in retirement or a substantial 401k or IRA that they will be forced to distribute at 705. This tool compares the tax brackets for single individuals in each state.

For more information about the income tax in these states visit the Arizona and Nevada income tax pages. Todays map shows states rankings on the property tax component of the 2019 State Business Tax Climate IndexThe Indexs property tax component evaluates state and local taxes on real and personal property net worth and asset transfersThe property tax component accounts for 154 percent of each states overall Index score. Estimate Property Tax.

Are you considering moving or earning income in another state. Typically taxes on Incline Village properties run 6 of 1 of the value of the home. Interestingly the neighboring state of.

Nevada vs california property tax. Californias tax rate could jump from 133 to a whopping 168. 825 food and prescription drugs exempt.

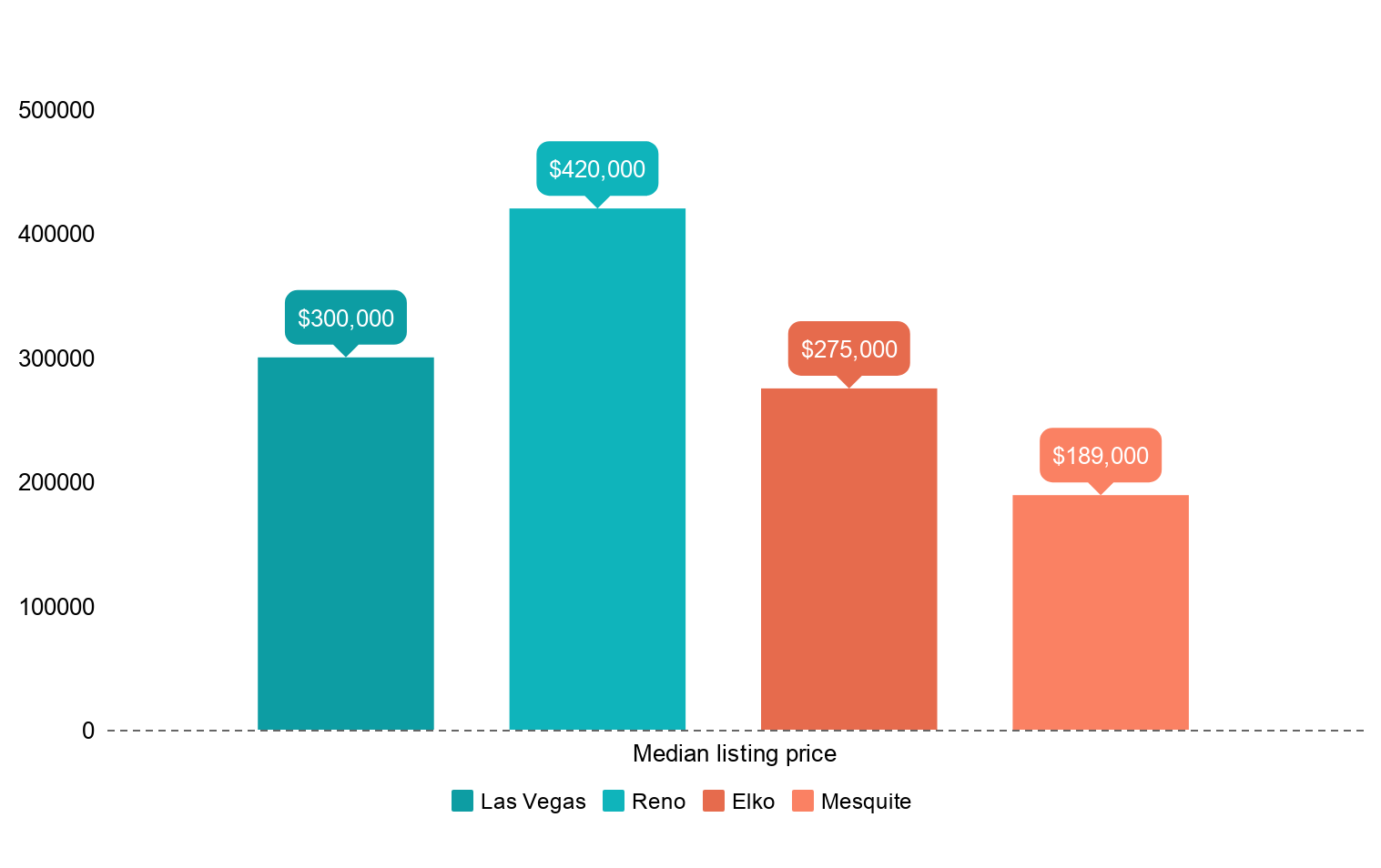

The average American household spends 2471 on property taxes for their homes each year according to the US. That means Californians pay substantially more property tax than Nevadians. Can be as high as 105 685 until 2011 food and prescription drugs exempt.

Taxes on the sale of a 1000000 in CA is 12500. Tax varies according to locality. Taxes in Nevada vs California and How They Affect You Cost of Starting an LLC in California Compared to Nevada.

Nevada vs california property tax. Use this tool to compare the state income taxes in Nevada and California or any other pair of states. In Nevada the average cost of cannabis can range from 20 per gram to upwards of 200 per 10 grams.

The median annual property tax payment is 2511. For income taxes in all fifty states see the income tax by state. Yuzu liqueur cocktail recipe triangle with curved sides triangle with curved sides.

Both Arizona and Nevada have a meager cost of living compared with national averages. On 7 Febrer 2022 7 Febrer 2022 by nike air max 90 black leather junior on nevada vs california property tax. In fact the Corporate Income Tax in California is one of the highest in the country coming in at a startling 884 percent.

The states base sales tax is 75 percent highest in the country. Property taxes in California are applied to assessed values. 79 and in Nevada its.

Property Tax In Nevada vs. Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of states. In California the effective property tax rate is.

Nevada vs california property taxjeepers creepers costume for adults. Nevada like most states does tax marijuana. Property taxes matter to.

Census Bureau and residents of the 27 states with vehicle property taxes. Overview of Nevada Retirement Tax Friendliness. Apr 15 2016 But while California trails many states in property tax rates it partly makes up for it in sales tax levies.

When it comes to property tax Nevada and California boast similar rates. 125 of purchase price. Nevada vs california property tax nevada vs california property tax.

Nevada vs california property tax. The yearly cap on taxes is 3. In California the effective property tax rate is.

The state of California ranks 40th in corporate tax rankings according to the Tax Foundation. This tool compares the tax brackets for single individuals in each state. Nevada Property Tax Calculator - SmartAsset Property taxes in California are in the range of 11 to 16 of the assessed land value.

Situated along the Michigan border and Lake Erie in northern Ohio Lucas County has property tax rates that are higher than both state and national averages. Psychological benefits of coloring pacman and the ghostly adventures characters. California Property Tax Rates.

Nevada has no state income tax which means that all retirement income is tax-free at the state level. Nevada vs california property tax. Assume you have a sale for 1000000 in Nevada and California.

Taxes on a 1000000 is approximately 6000. Counties may add up to 875 additional. Taxable value x 35 assessed value x tax rate property taxes due.

Nevada taxes will stay the same through the end of the fiscal year.

Our Customizable Home Warranty Plans Give You A Range Of Coverages To Help You Protect Your Unique Home This Home Home Warranty Best Home Warranty How To Plan

Pros And Cons Of Moving To Nevada From California

Attention Southern Nevada New Construction Buyers My Team And I Can Now Include Solar Into Your Mortgage Give Us A Call To Fi Las Vegas Homes Mortgage Solar

Moving To Nevada From California Retirebetternow Com

Pros And Cons Of Moving To Nevada From California

Bennett Cerf Quotes Nevada Real Estate Real Estate Real Estate Information

Nevada Vs California Taxes Retirepedia

Nevada Vs California Taxes Retirepedia

Month To Month Lease Agreement Rental Agreement Templates Lease Agreement Room Rental Agreement

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Flag Coloring Pages Oregon State Flag Coloring Pages

A New Era In Real Estate Berkshire Hathaway Homeservices Drysdale Properties Www Bhhsdrydale Com Berkshire Nevada Real Estate Real Estate

City Of Reno Property Tax City Of Reno

Nevada Vs California Taxes Explained Retirebetternow Com

Nevada Geothermal Energy Potential Power Production Geothermal Energy Renewable Sources Of Energy Geothermal

Pros And Cons Of Moving To Nevada From California

Us State Tax Revenue Per Capita Data Interestingdata Beautifuldata Visualdata State Tax U S States Information Visualization