how long does the irs have to collect back payroll taxes

If you do neither we will proceed with our proposed assessment. A trust fund tax is a money withheld from an employees wages income tax Social Security and Medicare taxes that is.

What Is Tax Resolution Solving Irs Tax Problems

This means that under normal circumstances the IRS can no longer pursue collections action against you if.

. Usually The Irs Has Ten Years To Collect Money You Owe How can long can the IRS come after you for back taxes. Generally speaking when it comes to a tax audit the IRS is only able to go back three years. How many years can the IRS collect back taxes.

If there are substantial errors they may go back further but typically no more than. What Is the IRS Collections Statute of Limitations. The collection statute expiration ends the.

When you owe money to the IRS are you on the hook. You will have 90 days to file your past due tax return or file a petition in Tax Court. If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4.

This is known as the statute of limitations. The IRS generally has 10 years from the date of assessment to collect on a balance due. This is the length of time it has to pursue any tax payments that have not been made.

If you have received notice. The tax assessment date can change. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years. The IRS 10 year window to collect.

The 10-year deadline for collecting. The IRS has a set collection period of 10 years. Can the IRS go back 10 years.

Unpaid payroll taxes are referred to by the IRS as trust fund taxes. As a general rule there is a ten year statute of limitations on IRS collections. If you dont pay on time.

The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. This means that the IRS can attempt to collect your unpaid taxes.

As already hinted at the statute of limitations on IRS debt is 10 years. Understanding collection actions 4 Collection actions in. If you did not file.

A tax assessment determines how much you owe.

Irs Can Audit For Three Years Six Or Forever Here S How To Tell

Unpaid Payroll Taxes Consequences And Resolution Options

Are There Statute Of Limitations For Irs Collections Brotman Law

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Irs Hardship Currently Non Collectable Alg

Irs Guidance Allows Workers A Payroll Tax Holiday

How Long Does The Irs Have To Collect Tax Liability Youtube

The Consequences Of Willful Failure To Pay Payroll Taxes

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

What To Do If You Owe The Irs Back Taxes H R Block

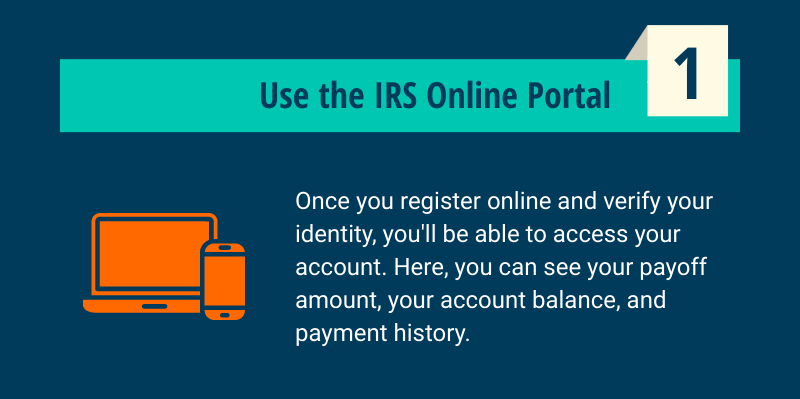

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Help My Business Owes Back Payroll Taxes To The Irs

Does The Irs Forgive Tax Debt After 10 Years

How Many Years Back Can The Irs Go In Its Search For Tax Fraud West Los Angeles California Irs Lawyer Dennis Brager

How Long Can The Irs Try To Collect A Debt

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

Does The Irs Forgive Tax Debt After 10 Years Heartland Tax Solutions

Social Security Administration S Master Earnings File Background Information